Construction new work output slips 0.4% in November

Construction new work output slips 0.4% in NovemberConstruction new work output in November fell 0.4% after being impacted by a near 5% fall in new build housing.

Overall total output remained flat, as a modest 0.6% increase in repair and maintenance work helped to offset the new work fall.

The fall in output was attributed to a wetter-than average November causing more difficult working conditions.

Tender price inflation to fall back to 2.5%

Tender price inflation to fall back to 2.5%Time has been called on rampant tender price inflation after it soared to an estimated 8% last year amid deepening concern about the impact a big fall in house building will have on the industry in 2023.

In the second downward revision for this year, tender price rises are now expected to rebalance at around 2.5%, down from the 5.5% high for 2023 predicted last Spring.

Construction heading for shallow recession in 2023

Construction heading for shallow recession in 2023It’s forecasted that a 1.7% dip in construction activity this year before the industry return to modest growth in 2024.

The strength of the wider economic headwinds has seen Experian’s construction forecasting unit downgrade its latest workload predictions.

But economists are still predicting a relatively shallow recession with inflation, higher borrowing costs and labour rate rises expected to fade next year allowing construction to ease back into a modest 1.1% growth in 2024.

Buyers report construction “stuck in the mud”

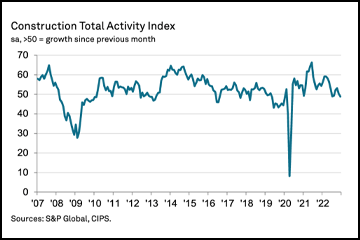

Buyers report construction “stuck in the mud”Construction buyers reported a fall in business activity during December as new orders also dropped at the fastest rate for over two-and-a-half-years.

The Bellwether S&P Global/UK Construction Purchasing Managers’ Index was 48.8 in December, down from 50.4 in November and below the crucial 50 no change mark for the first time since last August.

Commercial construction was the only rising sector at 50.3 on the index while civil engineering and house building contracted at 46.8 and 48.0 respectively.

Contractors reeling at latest building products price hikes

Contractors reeling at latest building products price hikesContractors are facing months of more building products price rises despite a drop in raw material and energy costs.

Plasterboard manufacturers have been the first to act in the new year with major manufacturers increasing by up to 17% while insulation materials are set to rise by around 10%.

Data complied by building products distribution giant SIG shows a series of other rises planned over the coming months including 10% hikes in roofing tiles.